A national mortgage system now offers additional aide to help you Indigenous Us citizens looking to buy, refinance or rehabilitate a home, but some possible applicants aren’t completely aware of the applying positives-otherwise the program is present.

Congress dependent this new Point 184 Indian Mortgage Verify Program to make homeownership more comfortable for Indigenous Us americans and also to improve Indigenous American communities‘ the means to access money, according to U.S. Institution from Homes and you will Metropolitan Development (HUD). Inside the 2019, 50.8% out of Western Indians and you will Alaska Neighbors owned a house, versus 73.3% regarding low-Latina white People in america, with respect to the You.S. Census Agency.

Money from the Part 184 system require a decreased minimum down payment-basically 2.25%, or only 1.25% having financing lower than $50,000-and private Mortgage Insurance (PMI) from just 0.25%.

By comparison, Government Casing Government (FHA) loan applicants having a great FICO rating out of 580 or maybe more you would like at least down payment out of step three.5%, when you find yourself individuals with Credit scores between five hundred and you can 579 you want good 10% down payment, according to most recent FHA Recommendations to own Consumers. PMI normally run any where from 0.58% to at least one.86% of your modern level of the mortgage, considering 2021 data about Metropolitan Institute.

„If you do that math, it will make a fairly massive difference,“ told you Karen Heston, elder mortgage banker that have BOK Financial Home loan when you look at the Oklahoma. The application permits Native Us americans to buy property-and spend seemingly nothing money up front to do this, she said.

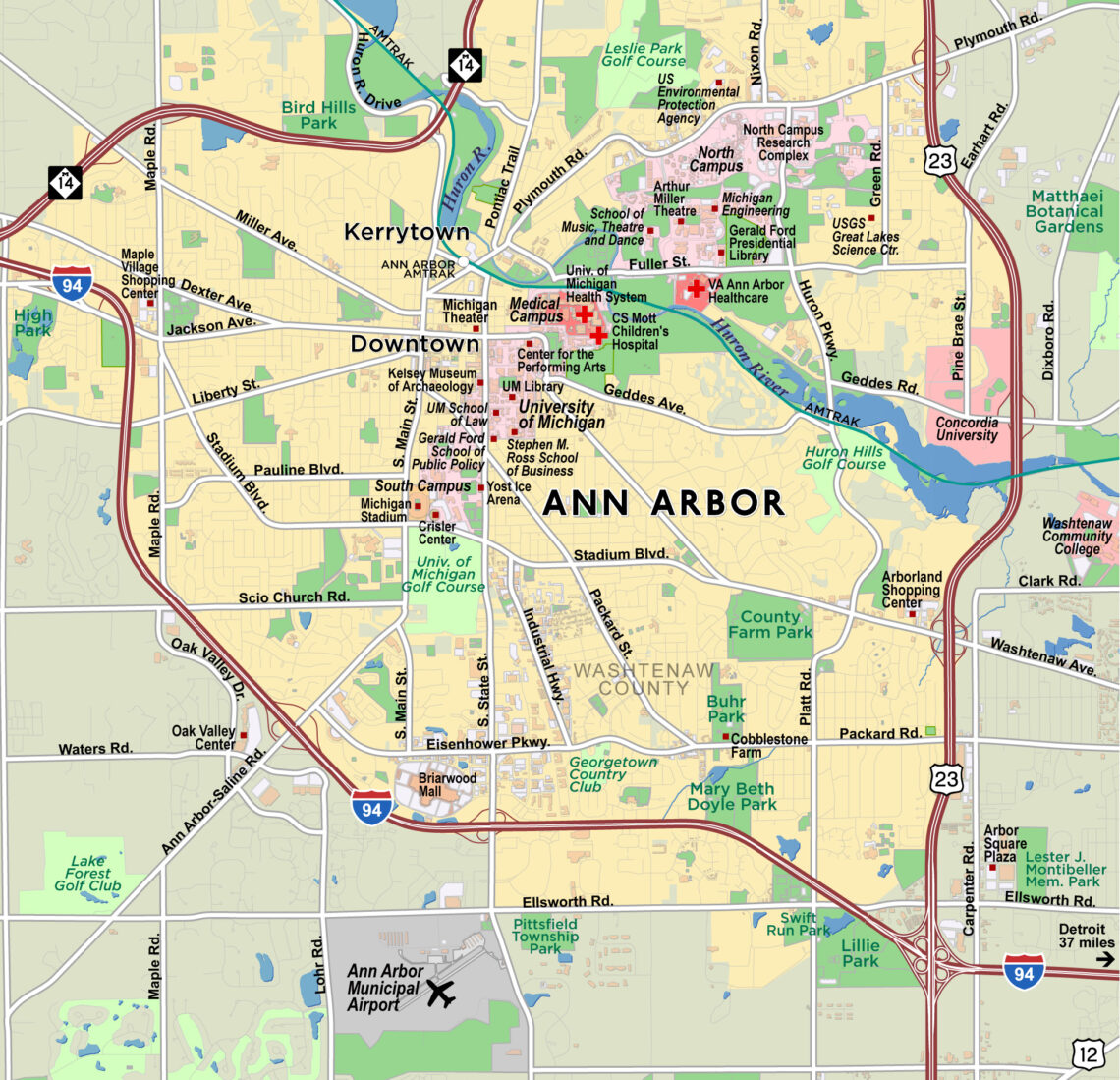

Already, Section 184 home loan money is totally for sale in twenty-four says, together with Oklahoma, Arizona, Colorado, Ohio, The latest Mexico and you will Utah. For the fourteen states, and Tx, New york and you can Connecticut, the brand new finance are just available in certain counties and you can towns and cities.

A full a number of approved financing parts is available to your HUD website. So you can be considered, you really must be a western Indian otherwise Alaska Local who is a member of good federally recognized tribe.

Area 184 financing strange

Even after the prevalent supply, financial lenders say that Section 184 funds compensate a fairly brief portion of the funds it techniques. BOK Economic is the most only a few lenders in a position to speed the new processes by giving Point 184 fund with respect to HUD, unlike sending files to help you HUD to own approval.

From inside the Oklahoma, Home loan Bankers Karen Heston and you can Terry Teel, said not many homeowners ask specifically regarding the Area 184 financing, as they may qualify. As an alternative, brand new bankers often have to bring up the program as a key part of one’s discussion.

In comparison, Elvira Yards-Duran, financial banker on the BOK Financial Mortgage, said way more Native Us citizens in the The fresh Mexico is really requesting the fresh new fund.

„These are typically becoming more and more common while the Local anyone read there can be a certain equipment out there in their mind-particularly now into tribal residential property,“ she said. „The tribal houses departments have the ability to help professionals remember that capable realize the objective of owning a home using this sorts of program.“

Some which inquire about brand new Area 184 loans don’t know the way they work, positives state. One common misconception is that the system brings deposit assistance, it cannot. The program does lessen the number of deposit requisite, although it does not give currency to the deposit.

Maybe not a ring-Services having bad credit

„It claims regarding assistance that there is maybe not the absolute minimum borrowing rating, that is a bit misleading once the HUD is also super fussy throughout the derogatory borrowing,“ Heston told you. The latest program’s created guidance wanted a loans-to-income proportion out-of no more than 41%.

Just how to calculate your debt-to-income proportion

„The merchandise is really in search of people that handle the borrowing in a timely fashion,“ Teel arranged. „When you yourself have marginal borrowing from the bank and you will collections, which is in the event it will get an issue with such mortgage.“

Since the a primary step, individuals should meet with a home loan banker to find out if they meet the requirements americash loans Woody Creek and you will, if not, what they will do to resolve one. Maintaining secure work, to stop the new costs, paying off the modern debts and spending less can also be all of the assist your qualify later or even now, M-Duran said.

„It’s simply the perfect device because the mortgage insurance is therefore reasonable versus a keen FHA loan. Next, you can piggyback it which have deposit or closing cost recommendations regarding tribe,“ Teel told you. „It really helps a qualifying buyer get into a property to have a good amount of cash.“

Begin Your Resource Now

Use on the web with our HomeNow application or reach out to a Home loan Banker to respond to the questions you have. Either way, we offer personal and you may conscious services to greatly help direct you by way of each step of the process.